Preview|GOOG 2Q25: Will AI Overview Generate Incremental Revenue for Google?

12 Expert Interviews, Agency Survey, AI Overview, AI Mode, Performance Max, ChatGPT, Antitrust

After writing a report on Google, Gemini, and Coding Agent in June, I still had many questions about AI Overview's impact on Google's ad revenue, especially given its low ad load in 2Q25-3Q25 despite strong CPC.

This comprehensive report is based on interviews with 12 experts and provides updates on:

Overall ad revenue trends for Q2 2025 and full-year 2025 expectations

AI Overview performance and implementation

AI Mode rollout and monetization potential

Performance Max, Conversational Ads, and other product innovations

Competitive impact from ChatGPT and Perplexity

Third-party research findings

Antitrust proceedings

Quarterly outlook

Overall Ad Business Growth

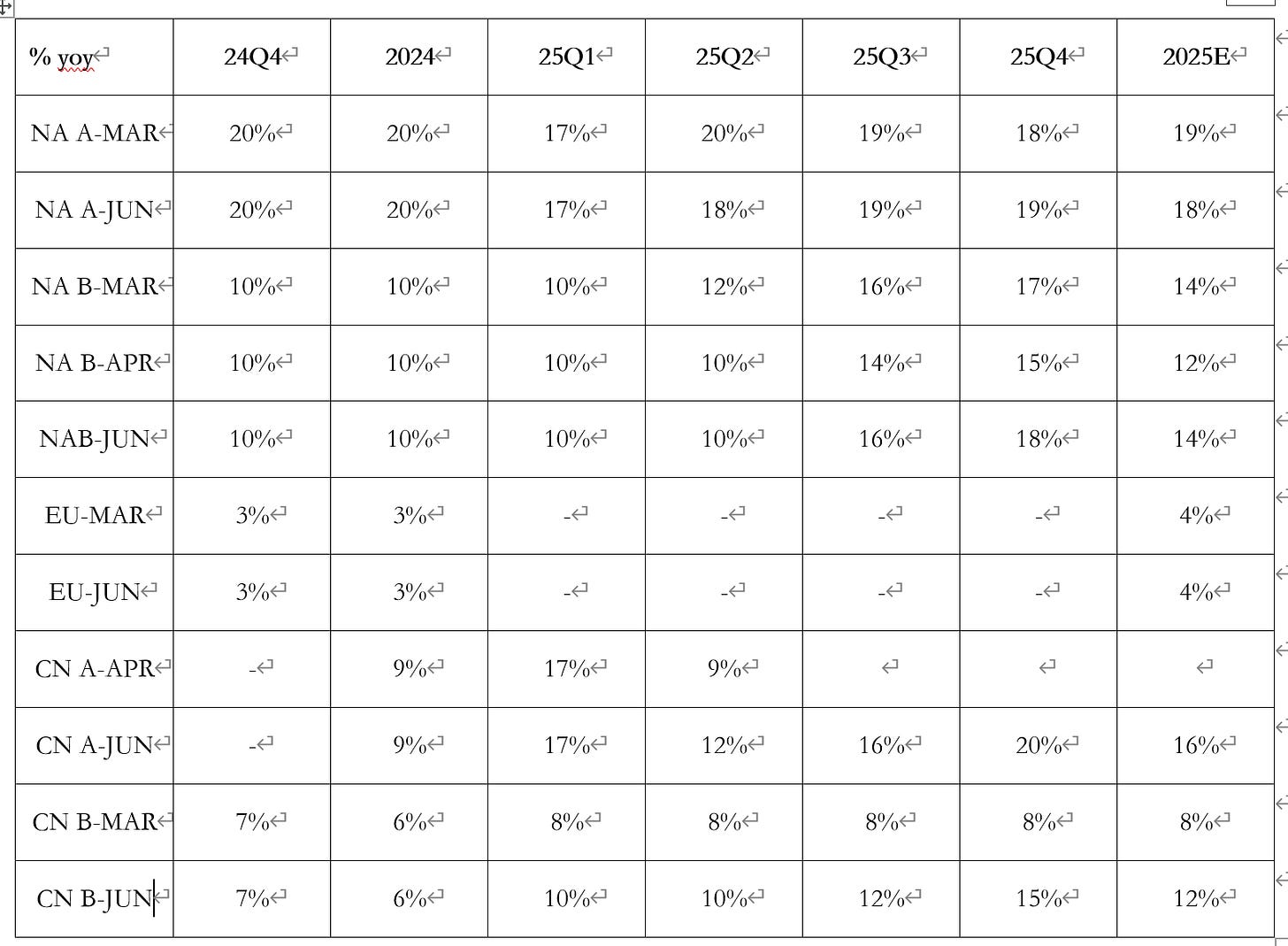

We recently spoke with five Google advertising agency experts. As this is our first quarter tracking Google budget performance, we lack historical data compared to META.

North America Expert A manages over $100M in annual omnichannel spend, with high concentration in e-commerce, gaming, and web services.

"4Q25 growth expectations are higher than our February pre-tariff estimates."

North America Expert B is a global 4A agency buyer managing over $200M in annual omnichannel budget, all in the US.

"2H25 expected to accelerate vs 1H25, driven primarily by increased budgets from e-commerce and CPG clients."

"Full-year figures may be revised upward. YouTube TC trends are strong. If they secure more exclusive streaming rights for football or basketball in 3Q25, we'll see significant advertising budget growth. We're also seeing Performance Max improving advertiser ROI this year."

Google is recommending advertisers shift more budget to YouTube or CPM-based search advertising.

European Expert works at a global 4A agency with over $200M in annual omnichannel budget. With budgets primarily in Europe, they haven't seen macroeconomic impacts.

"Current budgets remain essentially unchanged from March. We haven't revised up or down."

China Expert A manages approximately $100M in annual omnichannel budget, with 60% e-commerce related.

"Budget increases from April are mainly due to Performance Max and tariff moderation."

"2Q25 actual came in at 12%, better than the expected 9%."

China Expert B manages over $6B in annual omnichannel spend, primarily in gaming and web services.

"Performance slightly better than Meta. Mainly because Google provides more incentives to Chinese agencies, and we have fewer e-commerce clients on Google than Meta."

AI Overview

We spoke with 11 advertising agencies (five North American experts, one European expert, three Chinese experts, one Indian expert, one APAC conversion specialist) and one major advertiser (e-commerce platform). We plan to discuss search query, ad impressions, ad pricing, and overall impact on Google advertising.

Search Query Impact

North America Expert C:

Google search overall query is still growing, but desktop browsers are affected (1/3 of search query), while mobile remains unaffected (2/3).

Recently GPT's hallucinations have decreased significantly. Users may reduce Google searches after using GPT, leading to desktop search query decline.

Keep reading with a 7-day free trial

Subscribe to FundamentalBottom to keep reading this post and get 7 days of free access to the full post archives.